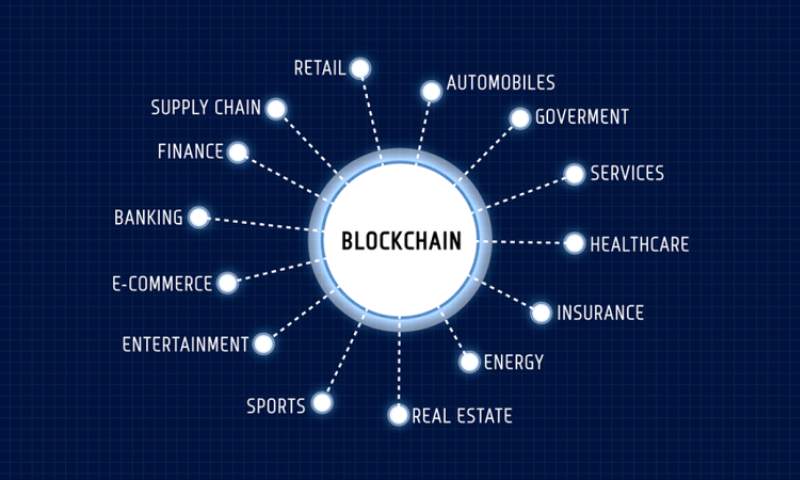

The landscape is shifting. What we’ve seen so far is just the start. Regulations for blockchain in the future will reshape how we use digital assets and how businesses thrive in this space. In this deep dive, I’ll untangle the threads of emerging laws and the effects they’ll have on you and the wider blockchain community. With governments eyeing the crypto surge, it’s crucial to know how these changes could hit home. So, let’s forge ahead into what lies beyond the horizon of blockchain’s wild west and get ready for the new rules of the game.

The Evolving Landscape of Cryptocurrency Regulations

Anticipating Changes in Cryptocurrency Regulation Trends

Cryptocurrency is the future of money. But with great tech comes big rules. We must be ready for shifts in crypto laws. Right now, rules change fast. We need to guess what’s coming. Think of it as weather forecasting. We look for signs to prepare. It keeps our crypto journey smooth.

Why is this important? Well, if you use crypto, it affects you. It decides if you can trade, how much it costs, and if your money is safe. Understanding trends is like having a map in unknown lands. It’s not just useful; it’s needed for survival.

The Progression of Blockchain Compliance Standards

Next, let’s chat about blockchain rules. These are like game rules but for using blockchain. They keep things fair and safe. Knowing them helps you play the game right.

Think of blockchain like a team sport. We need all players to follow the same playbook. That’s what blockchain compliance standards do. And just like sports, rules update to keep the game fair. In our game, the rules protect your money and your info.

We keep an eye out for updates in anti-money laundering (AML) and know your customer (KYC) stuff. These rules mean only good guys are in our game. They help stop bad stuff like crime and scamming.

We work with big names, like government blockchain groups and the Financial Conduct Authority. They help set the rules. The aim is to keep crypto safe for everyone.

Here’s the cool part. We also may see new tech like central bank digital money. This means even banks hop into crypto.

Blockchain rules don’t just sit still. They grow just like the tech does. It can be a lot to keep up with, but it’s what keeps your crypto fun and fair.

In short, the future of crypto and blockchain is bright. We’ve got exciting ideas on the way. But to win, we must know the game rules and play our part. That’s how we all score in the world of crypto.

Future Legal Challenges for Smart Contracts and Digital Assets

Upcoming Developments in Smart Contract Laws

Smart contract laws are changing. Soon they will match our fast tech world. As an expert, I see the future of smart contract laws becoming more complex. Lawmakers are racing to catch up with tech leaps. This means more rules for using smart contracts fairly and safely.

We already have some rules for digital deals. But smart contracts can do much more. They deal with things like houses and, sometimes, big money. So, we need clear laws that spell out how to use them right. This makes sure everyone plays fair and knows what to expect.

People ask, “What’s a smart contract?” It’s like a deal you make on a computer. It runs by itself when certain things happen. No person needs to check it. Think of a vending machine. You pay, and it gives you a snack. Smart contracts do similar things but with digital stuff like money or property rights.

Adapting to Advanced Digital Currency Oversight Mechanisms

Digital money, like Bitcoin, needs good rules too. These rules make sure money is clean and belongs to who says it does. The AML blockchain rules help stop bad guys from hiding stolen money. KYC protocol for blockchain makes sure we know who we deal with on these networks.

As tech grows, these rules will get tighter. We have to watch for new ways people might cheat or break the law. Strong rules will protect buyers and sellers. They will help honest people trust digital money more.

Today, governments and big banks are making new types of money. We call these central bank digital currencies. Just like coins and bills, they need rules. These rules keep your money safe. They tell banks how to use this new money best.

What about when countries work together? Here, it gets tricky. Every country has its own rules. Cross-border blockchain controls make sure people follow rules, even when in different countries. Soon, these controls will grow stronger, helping people make deals across the world without worry.

Blockchain is also reaching into more businesses. Banks and shops want to use it because it can make trading faster and cheaper. The blockchain in financial services regulation is growing. This ensures that when you use blockchain to save or send money, it’s done right.

Tech makes our lives easier. It also brings big changes to laws. Future proofing blockchain laws means being ready for these changes. It means making sure people can trust their money and deals to this new tech.

For all of us diving into this digital world, it’s a wild ride. Smart contract laws and digital currency rules are part of this. They build a safe path for us to follow. If you’re into crypto or thinking about it, keep your eyes open. Big changes are coming, and they’re sure to make a splash.

Enhancing Global Blockchain Operations through Regulatory Harmony

Navigating Cross-Border Blockchain Controls

The world is getting smaller. Things we do cross into other places fast. This includes blockchain, the tech behind Bitcoin and other digital money. Different countries make different rules for it. We need to work together to make things smooth. Cross-border blockchain controls help with this. They make sure rules are the same or work well together across borders.

Countries talk to each other. They try to match rules for blockchain. This helps businesses grow and go beyond their own country. It’s like when two puzzle pieces fit just right. But it’s hard to do. Every place has its own ideas and rules. Some like to control things a lot. Others not so much.

To make this happen, countries use big meetings and groups. They share ideas about cryptocurrency regulation trends. They try to make a single plan that fits everyone. This is good for us. It means less trouble when using blockchain from one place to another.

Implementing AML and KYC Protocols in Blockchain Systems

We also need to keep things safe and clean. This is where AML (anti-money laundering) and KYC (know your customer) come in. These are rules to stop bad money moves. They also help to know who is using blockchain.

Think of AML like a filter. It keeps the bad stuff out. And KYC? It’s like a check-up. It makes sure the person using blockchain is who they say they are. When we bring these into blockchain, it gets safer. And not just safer. It gets trust too. Trust is key for people to use new tech.

Putting AML and KYC in blockchain is not easy. It has many steps. And it needs everyone to agree. This includes people who make blockchain compliance standards. Also, those who watch over banks and money.

One big player here is the Financial Conduct Authority. They’re like a coach for the money world in the UK. They help make the rules clear. This way, businesses know what to do. And everyone plays fair.

With these rules in place, we can weed out bad use and trust blockchain more. This brings in good business. It also makes sure people’s rights are safe.

So, doing AML and KYC right helps a lot. It makes blockchain clean, safe, and ready for growth. And when it grows, it can do so much good. It can make money move easier. It can make things less costly and faster too.

As we look ahead, these steps are massive. They help future-proof blockchain. And they let it do its job well. The job to make our money world work better for all. It’s a big task but an exciting one too. And doing it together, respecting each law and land, makes us all winners.

Governmental and Institutional Involvement in Blockchain Supervision

Coordinating with Blockchain Regulatory Bodies

We’re journeying into a future where the rules for blockchain will get clearer. Cryptocurrency regulation trends are like the weather—they change often. My job is to keep up and guide folks. Whether it’s for a fresh startup or a big bank, I understand the rules that matter. I’m talking about blockchain compliance standards designed to keep things safe and fair.

Think of blockchain regulatory bodies as referees in a sports game. They make the calls. In the world of blockchain, they decide what’s legal and what’s not. For instance, the Financial Conduct Authority checks whether companies play by the rules in the UK.

Teaming up with these big players is key. They hold the map as we sail the blockchain sea. We look at what they say about managing digital money and using smart tech like blockchain. So, we meet, we talk, and we plan. And by doing so, we make sure you can trust the digital coins in your virtual pocket.

But here’s where it gets real interesting. The future of smart contract laws is on the horizon. These laws will decide how smart contracts work and how we keep them in check. It’s wild to think we can now have contracts that speak tech language and self-execute!

Projecting the Influence of Central Bank Digital Currency Regulations

Now, let’s shift our gaze to the big fish: central banks. They’re diving deep into blockchain with central bank digital currencies, or CBDCs for short. This is the next big wave that could change how money moves around the world.

With CBDCs, central banks enter the digital playground. They bring with them rules to shape the game. We’re talking about central bank digital currency regulations. These rules ensure that digital bucks are safe to use and don’t cause financial storms.

Each country’s central bank might roll differently. That’s where cross-border blockchain controls come in. They’re like traffic lights at country borders. They help manage how digital money flows from one place to another.

Let’s not forget anti-money laundering (AML) blockchain rules and the know your customer (KYC) protocol. They’re like lifeguards keeping the blockchain pool safe. They check the water to keep the bad actors out. And they ensure that everyone swimming in the crypto pool feels secure.

To sum it up, the future’s looking bright as governments and institutions amp up their game. They’re making sure blockchain grows up right, following the law every step of the way. And as we ride this wave together, trust me, it’s going to be an exciting journey.

To wrap things up, we’ve covered a lot about crypto rules changing, blockchain getting more official, and what’s ahead for smart contracts. Laws will catch up with tech, and that means more checks on digital cash. We’ve seen how countries might work together on this, and how important money safety rules like AML and KYC fit into blockchain.

It’s clear we’re heading towards a world where blockchain is part of everyday life, not just a tech for a few. That’s big! Banks might even get their own digital money. We must stay sharp and adapt to these shifts. Stick around for more updates as we follow this exciting road. It’s going to be an interesting ride, for sure!

Q&A :

How might regulations impact the future growth of blockchain technology?

The regulatory environment for blockchain technology is evolving, and its future growth could be significantly influenced by how governments around the world decide to control or facilitate its use. Regulations could ensure stability, enhance security, and protect consumers, potentially leading to increased adoption. On the other hand, overly stringent regulations could stifle innovation and limit the technology’s potential.

What are the potential benefits of regulating blockchain technology?

Regulating blockchain technology could bring about various benefits, such as minimizing fraudulent activities, ensuring compliance with international standards, facilitating interoperability between systems, and promoting user trust. Regulation can also pave the way for greater institutional investment and broader adoption by establishing clear legal frameworks.

Could future blockchain regulations affect cryptocurrency markets?

Yes, future blockchain regulations are likely to have an impact on cryptocurrency markets. Depending on the nature of the regulations, this could either enhance the market’s stability and legitimacy, attracting more investors, or it could lead to a decrease in trading volumes if the regulations are perceived as restrictive or punitive.

What steps are governments taking to regulate blockchain technology?

Different governments are taking varied approaches to regulate blockchain technology, ranging from creating task forces to study the technology, drafting specific laws to govern its use, to implementing existing financial laws to cover blockchain-based activities. Some are setting up sandboxes to allow for innovation without compromising regulatory standards.

How can blockchain companies prepare for potential future regulations?

Blockchain companies can prepare for potential future regulations by proactively adopting best practices for security, transparency, and compliance. Staying informed about regulatory trends, engaging with policymakers, and participating in industry standards development can help companies adapt to new regulations swiftly and effectively.