Frontrunning Attack Decoded: Is Your Crypto Safe?

In crypto trading, sharks are always circling. Ever wondered, What is a frontrunning attack? It’s a sneaky play where these sharks see your trade coming and race ahead to profit at your expense. It’s like spotting the fastest cashier lane at the supermarket and someone cuts in front. Frustrating, right? But in the high-stakes world of crypto, this can mean serious money lost. Understanding how these attacks happen is key to keeping your digital coins out of the jaws of predators. Let’s dive deep into the murky waters of frontend attacks and arm you with the know-how to safeguard your crypto.

Unpacking Frontrunning in Crypto: The Basics

Understanding Frontrunning Attacks

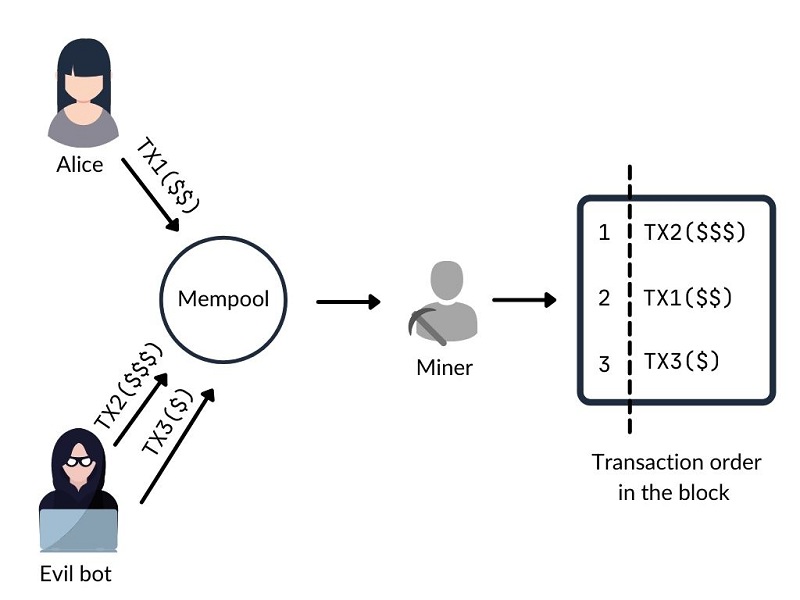

Imagine standing in line to buy a ticket. You’re up next when suddenly, someone cuts in front. That’s like frontrunning in crypto. It’s when someone makes a trade knowing others’ trades are coming and profits from this knowledge. They see your move, jump the queue, and buy or sell faster for gains. In crypto, this can happen because trades wait in a public place, called the mempool, before final approval. Here, crafty folks can spy and act fast to get ahead. In the end, you might pay more or get less money back than expected.

The Role of Blockchain Security in Preventing Frontrunning

To stop these sneaky moves, we ramp up blockchain security. Picture a high-tech alarm system that watches over your house. For crypto, we build digital defenses to keep an eye on the trading line. We use smart contract security, think of it as a robot referee, to enforce fair play. And we teach systems to detect front runners, sort of like having a guard dog that only barks at intruders. Stopping front runners means each trader has an equal shot, keeps prices fair, and makes sure no one’s tricking the system to win.

In this crypto jungle, trading safe is key. We always work to seal any cracks where front runners can sneak through. It’s a bit like a game of cat and mouse, with security experts and front runners always on the move. But don’t let that scare you. We’re getting better every day at protecting trades and making sure playing the game is fair for everyone.

Mechanisms of Market Abuse: From Slippage to Sandwich Attacks

Exploring Types of Trading Manipulation

Trading manipulation hurts all of us. It’s like a cheat in a game, but this game is real life with real money. Let’s take a close look at what’s going wrong. In crypto, frontrunning is one cheat that’s causing trouble. It’s when someone trades first, using info that we don’t have yet. They see our trade coming and jump the line. This is like seeing someone bet on a winning horse and placing the same bet before them, so you win more.

Think of standing in line; you’re next. Someone knows you’ll buy a hot toy, dashes in front, and snags it. Now they offer it to you for more money. That’s what happens to your crypto trades too. Bad, right? We must fight this. People are using bots, called flash bots, to make these sneaky first trades. It’s smart but super unfair.

Now, slippage is a bit different. This happens when the price changes from when you say “trade” to when it actually trades. Like buying a candy bar and finding out at the register it’s pricier than the tag said. Not cool.

Then there’s the sandwich attack. Imagine you’re buying a sandwich; the price goes up because someone else is buying all the sandwiches to sell them for more. They buy before and after you, making your purchase cost more. It’s a sneaky double jump in the line.

Analyzing High-Frequency Trading and Exchange Vulnerabilities

High-frequency trading is like super fast trading by computers. They do it so fast that we can’t even see it. They have a speed secret and can see the prices changing before us. It’s not fair play when these computers can trade in a blink.

Exchange vulnerabilities are weak spots where cheats can happen. It’s like a game where some know how to score easy because they found a glitch. Blockchain security tries to fix these glitches. We need our tech to guard our trades like dragons guard treasure.

Blockchain transaction ordering could use better rules. Right now, it’s a wild west. Whoever’s quickest to draw gets to trade first, which is bad news for us regular folks just wanting a fair shot.

Smart contract security is also a big deal. These are the rules about who trades what and when. If they’re weak, someone can break in and mess up everything. Think about fixing a race so only one car has a super engine. We need a fair race, right?

In short, we’ve got to keep our crypto games fair and square. No line cutting, no pricing games, no quick-draw contests. Let’s push for blockchain security that plays fair for all. Blockchain monitoring tools can help catch the cheaters. And with solid smart contract security, our trades stay safe. Let’s keep investing time and smarts into these areas. It’s how we’ll keep our crypto safe and play a fair trading game.

The Path to Ethical Trading: Front Running Prevention and Market Fairness

Safeguarding Against Exploiting Transaction Ordering

Ever had someone cut in line? Not fun, right? Well, in the crypto world, something similar happens. It goes by “frontrunning in crypto.” When someone trades with inside info about upcoming trades, they can beat you to the punch. It’s like they see your next move and hurry up to take advantage before you can blink.

Frontrunning is unfair. It hurts market fairness. Decentralized finance risks are real, folks. We gotta stay sharp and keep our digital coins safe. It’s a bit of a wild west out there, with blockchain security trying to tame it.

So, how do we fight this? We look at the rules of the game—what we call “blockchain transaction ordering.” Smart folks see every bit of data waiting its turn to join the blockchain. It’s called mempool data. With quick moves, these players can jump the line. But don’t sweat! We’ve got “front running prevention” in our playbook.

One trick to stop them is using “flash bots.” They help honest trades cut in front and block the bad guys. It’s a tech face-off to keep things fair. High-frequency trading guys want to game the system too. But with flash bots around, it’s tougher to sneak in those dirty moves.

The Ethereum blockchain’s got its weaknesses, yeah. It’s tempting for sneaky traders hunting for an easy score. But smart contract security’s leveling up. We’re building cyber walls no trickster can climb. So don’t worry, we’ve got people keeping your back safe.

And what about all those trading bots? Some of them are good guys, really! The right bots can shield your trades from frontrunners. With clever “algorithmic trading strategies” and “smart order routing,” you can race ahead. It’s like choosing the best path in a maze, getting to the prize first.

But let’s not forget, a clean fight needs strong refs. That’s where “regulatory approaches to uphold financial market integrity” come in. Yep, we need rules that everyone plays by.

Regulatory Approaches to Uphold Financial Market Integrity

Rules are not just for sports. The market’s got ’em too. “Financial market integrity” means no cheating, plain and simple. Regulators step in to keep players honest. “Regulatory guidance on frontrunning”—think of it as the rulebook. It’s got the dos and don’ts to keep the trading game fair.

We call on watchdogs with top-notch “blockchain monitoring tools.” They’re like hawks, eyeing every move on the chain. Spotting the cons, the cheats, the slick scams. They flag the “slippage and fraud,” and set alarms when things look fishy.

Crypto’s got its flaws, but we’re patching it up. Safeguarding “digital assets” and shutting down “sandwich attacks.” It’s a bit like patching up the holes in a boat – keeps it from sinking.

Every player wants a fair chance. No one should feel like the game’s rigged from the start. That’s why we’re pushing back on “unethical trading practices.” We want “market fairness.” That means investing in “secure trading platforms.” Ones that you can trust, like a sturdy bank vault for your coins.

It’s all about staying one step ahead. So, let’s keep our crypto safe, play fair, and, hey, let the best trader win!

Advances in Technology: Tools and Strategies to Protect Your Crypto

Blockchain Monitoring for Suspicious Activity

Let’s face facts. We live in a world where frontrunning in crypto is a real threat. It’s a sneaky move where someone trades on upcoming transactions they see waiting. It’s not fair, and it’s not what the Ethereum blockchain stands for. Think of cutting in line, but with digital money—and the stakes are high.

We need to tackle this. And the solution? It’s a combo of tech and smarts. First off, blockchain monitoring tools are key. They’re like watchdogs for the digital landscape. They sniff out weird patterns and alert us to possible trading manipulation. This way, we stay one step ahead of the sneaks.

But we can’t just sit back and watch. We have to move, change, and adapt. We need smart contract security that’s tough as nails. Smart contracts handle our deals, but are they safe? Not always. That’s where front running prevention steps in. Safer contracts mean safer trades.

Leveraging Smart Order Routing and Algorithmic Defenses

Now, let me get into the nitty-gritty. Smart order routing is our secret weapon. It’s all about making quick and smart trade paths. This means orders get filled at the best prices without alerting the frontrunners. Clever, right?

And we can’t forget about algorithmic trading strategies. They’re like chess moves in the world of high-frequency trading. Algorithms decide in a blitz how and when to trade. They shut down frontrunners by outpacing them.

Here’s the thing about crypto trading bots. They could be tricky. They move fast. Very fast. But with the right rules, they do more good than harm. They can spot a frontrunning attack and side-step it, keeping your crypto safe.

We’ve talked about blockchain security. It’s not just about one magic fix. It’s about layers. Layers of smart moves and tech that protect our digital bucks. So let’s keep building those layers and keep our trades safe from those line-cutters.

And folks, don’t overlook something called miner extractable value (MEV). It’s the extra dough miners might get by picking and choosing transactions. It can lead to frontrunning, too. We need to keep an eye on it.

Remember, it’s not just about tech. We need everyone on board. We’re talking builders, traders, and even those big players who set the rules. Regulatory guidance on frontrunning? Yeah, we need that. It’s about everyone playing fair for market fairness.

In the end, every layer adds up. And each one makes it a bit harder for those bad players to mess with our money. That’s how we build an exchange that everyone can trust. And trust is what will keep crypto solid into the future.

In this post, we dived deep into the shady world of frontrunning in the crypto market. We learned what frontrunning attacks are and the need for solid blockchain security to stop them. Then, we looked at different ways traders can mess with markets, like slippage and sandwich attacks. We talked about how tech can be used both for good and bad in high-speed trading and what makes exchanges weak.

We also talked about fair play in trading and the steps we can take to prevent sneaky moves and keep markets honest. It’s clear that both tech tools and smart rules play a big part in this fight. Staying ahead means watching the blockchain for weird stuff and using clever order systems and tech defenses to keep our crypto safe.

As an expert, I think the path to clean trading is both exciting and tricky. But with the right mix of tech, smarts, and fair rules, we can work towards a market where everyone plays by the book and trusts are high. Keep these tips in mind to protect your investments and trade the right way. Let’s aim for a future where crypto trading is safe and fair for all!

Q&A :

What exactly is a frontrunning attack in crypto?

A frontrunning attack in the cryptocurrency context is when a malicious entity exploits the ability to see other users’ transactions that are waiting in a blockchain’s mempool and acts upon this visibility by placing their own transaction first with a higher gas fee. This typically happens in decentralized exchanges and can result in the attacker profiting at the expense of other users.

How does a frontrunning attack occur on blockchain platforms?

Frontrunning attacks on blockchain platforms occur when someone observes pending transactions and uses the knowledge of these future transactions to their advantage. They usually accomplish this by paying a higher transaction fee to prioritize their transaction over the original one that’s waiting to be processed. This situation commonly happens in trading environments, where an attacker could benefit from slight price changes.

Can frontrunning be prevented in blockchain transactions?

There are methods to mitigate the risk of frontrunning in blockchain transactions. One is using time-lock contracts that delay the execution of a transaction, making it harder to be frontrun. Another is executing trades using privacy protocols or private transactions that conceal the details until they’re finalized. Developers and users must be proactive in considering potential frontrunning risks and employ strategies to reduce them.

Why is frontrunning considered a security issue in decentralized finance (DeFi)?

Frontrunning is a crucial security issue in decentralized finance (DeFi) because it undermines the integrity of the financial system. The trustless environment expected in DeFi is compromised when users can be systematically disadvantaged by others who have access to specialized tools or more information. Additionally, frontrunning can lead to market manipulation and loss of funds, eroding user confidence and fair access to financial services.

What are some examples of frontrunning attacks in DeFi?

Examples of frontrunning attacks in DeFi include jumping ahead of large trade orders to benefit from the impact on an asset’s price, also known as “slippage.” Another example could be when an attacker exploits a known smart contract vulnerability before a patch can be deployed, by monitoring pending governance proposals. These types of attacks can cause significant financial damage to the victims and the overall health of the DeFi ecosystem.